Commercializing 9-11

Wells Fargo ATM 9-11 Memorial Message

Dear Mr. and Mrs. Corporate Person:

I seriously do not need any commerical mention of September 11th. Really.

Try as you might, I don’t think there is any way you can tastefully sneak in a reference to 9-11 in your business messages and not seem like you’re jumping aboard an emotional bandwagon for your crass commerical purpose.

Businesses large and small: I want you to leave 9-11 out of your sales and client communications, okay?

I have first-hand evidence that you’re having trouble steering clear of tying your business with the 9-11 anniversary. You’ve made me personally witness your weakness for cheap group hugs.

As I was rushing around yesterday morning between two appointments I hustled up to a Wells Fargo ATM for a quick hit of cash. It was a normal take-the-money-and-run transaction until I’d made my selection and started the 10-second wait for the system to validate my account and spit the $20 bills at me.

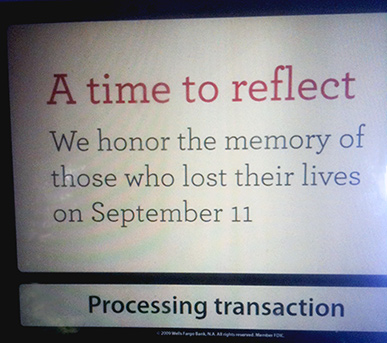

The ATM screen displayed a special “holiday” message as I waited for the money. It told me it was a time for reflection and wanted me to know that Wells Fargo honors the people who died on 9-11. The bank has apparently decided that it is perfectly appropriate to use the 9-11 anniversary as a way to show their corporate good-guy Americanism.

The ATM message struck me as simply wrong. On so many levels. Stop it!

First, the 10-second interval while I wait for the cash to dispense is not enough time to reflect on anything serious. Certainly it’s not enough time to consider something as deep and complex as 9-11. Besides, I don’t really think that Wells wanted me to start a 9-11 reflection right then. Wells was really bragging about their own reflections on 9-11, when, frankly, they can reflect to their hearts content in private.

My ATM mind is not in reflective mode, anyway. I am rushing around in my petty little errand mode. Shoving 9-11 in my face is an unwelcome intrusion. I cannot do the topic justice, and I don’t expect my ATM to be my meditation guide in any event.

At best, Wells is playing on my emotions and somehow getting me to bond with Wells, as if the company were a fellow 9-11 trauma victim. Or, something more complex, subtle, or whatever. But, it boils down to Wells using 9-11 for its commerical purpose. I don’t like it.

True, the message was simple and about as low-key as it could get. There was no direct attempt to monetize the 9-11 anniversary with a commemorative purchase.

But, I am not ready for 9-11 to be transformed into a seasonal slogan on an ATM screen. I am not ready for it to be used by any business for any purpose. Sometimes in marketing events are too raw to try to employ them for your business. September 11th is still one of those un-commercializable events.

On the 10th anniversary of the attacks, businesses do not need to tell us to reflect. Nor should they tout how much they themselves honor the dead. Some activities are best left to flesh-and-blood humans.